Financial Elder Abuse Reporting Act

A recent study published by MetLife Mature Market Institute estimates the financial loss by victims of elder financial crimes and exploitation exceeds 29 billion dollars annually. The new law formalizes the ability of banks and other financial providers to report such suspected abuse.

How To Report Elder Financial Exploitation

11570 identifying the need for data on elder abuse.

Financial elder abuse reporting act. The Elder Abuse Reporting Act was implemented to make it everyones legal responsibility to stand watch and report any suspicion of elder abuse. Older adults can be attractive targets for financial exploitation and may be taken advantage of by scam artists financial advisors family members caregivers or home repair. The Senior Safe Act modeled on a program by the same name in Maine will empower and encourage our financial service representatives to identify warning signs of common scams and help prevent seniors from becoming victims says Sen.

APS are social services programs in each state. Financial Crimes Against Nursing Home Residents Financial Service Providers - Credit Card Bank Loan Issues Identity Theft Internet Crimes - Computer Hacked Online Extortion or Money Laundering IRS Tax Scam or Mail Theft. In the case of family members they may see the older person as an easy way to get money for their own needs that can range from rent and food to drugs or alcohol or to make extravagant purchases.

Firms can use this presentation to train associated persons about how to detect prevent and report financial exploitation of senior and vulnerable adult investors. Reporting Contact Info Office of Elder Fraud Assistance. Adult Protective Services is a common term but this may not be the name of the agency in your state.

Abuse reports may also be made to you local law enforcement agency. Published September 13 2016. If you suspect elder financial abuse report it to Adult Protective Services APS.

In September 2005 California Gov. 1561027 and 1561023 an elder is any person who is age 65. Financial Elder Abuse Reporting Act of 2005.

But any person may report exploitation of vulnerable adults. 1 Takes secretes appropriates obtains or retains real or personal property of an elder or dependent adult for a wrongful use or with intent to defraud or both. The Financial Elder Abuse Reporting Act of 2005 Act requires the reporting of any fraudulent use of an elders drafts checks or orders drawn upon any bank credit union or savings association.

The training serves as a resource for firms implementing the requirements of the federal Senior Safe Act Section 303 of the Economic Growth Regulatory Relief and. 5 The Guidance clarifies that reporting financial abuse of older adults to appropriate authorities does not in general violate the privacy provisions of GLBA. Arnold Schwarzenegger signed the Financial Elder Abuse Reporting Act in an effort to help protect the elderly citizens of California from financial abuse by family members.

Contents Prevent elder financial Dependent adult civil protection act mandates Older americans report Financial protection bureau Even with liability protections currently in place for advisors who report suspected elder abuse if they act preemptively or if the client is bothered by the advisors actions the advisor will. 2017 President Trump signed into law the Elder Abuse Prevention and Prosecution Act of 2017 PL. Officers and Employees of financial institutions in California are mandated to report suspected elder financial abuse and required to submit a special report known as the Report of Suspected Dependent AdultElder Financial Abuse SOC 342.

Department of Justices National Elder Fraud Hotline 833-372-8311 is staffed by case managers who can guide you through local state and federal reporting procedures and connect you with other assistance. Provided By Adult Protective Services County of Orange. Financial abuse of the elderly and dependent adult populations has been a long recognized and growing problem.

They serve older adults and adults with disabilities who need help due to abuse neglect or exploitation. The Gramm-Leach-Bliley Act generally requires that a financial institution notify consumers and give them an. Abusers may believe they are justified.

Elder financial abusers can be family members or people with whom the older person has had a relationship. Adult Protective Services APS at 800-451-5155 24-Hour Hotline Instructional Materials Regarding. The oral or written report may be made to the adult protective services agency.

This is in response to the increasing financial attacks on the elderly. Telephone Number 1-907-334-5989. Reporting Financial Abuse of Older Adults Guidance.

Email Address doaopaelderfraudalaskagov. A Financial abuse of an elder or dependent adult occurs when a person or entity does any of the following. Facts on Financial Abuse.

Todays guidance clarifies that it is generally acceptable under the law for financial institutions to report suspected elder financial abuse to appropriate local state or federal agencies. The Older Americans Act of 2006 defines elder financial abuse or financial exploitation as the fraudulent or otherwise illegal unauthorized or improper act or process of an individual including a caregiver or fiduciary that uses the resources of an older individual for monetary or personal benefit profit or gain or that results in. The Texas Legislature recently enacted a new law that criminalizes the financial abuse of the elderly.

Seven federal regulatory agencies today issued guidance to clarify that the privacy provisions of the Gramm-Leach-Bliley Act generally permit financial institutions to report suspected elder financial abuse to appropriate authorities. Californias mandatory reporting statute requires all officers and employees of banks and financial institutions to report known or suspected cases of financial abuse involving an elder or dependent adult. The following forms are to assist you.

Transactional Hold or Delayed Disbursement No. An elder abuse case has many stages from the incident through investigation by adult protective services or law enforcement prosecution and trauma recovery. The Senior Safe Act Fact Sheet provides.

Reporting Elder Financial Abuse If you want to report elder financial abuse contact your local county APS Office PDF. Mandated Reporter No. Thirty-three states the District of Columbia and Puerto Rico addressed financial exploitation of the elderly and vulnerable adults in the 2015 legislative session.

Monday May 16 2022. If the alleged exploitation takes place at a nursing home or assisted living facility contact the states long-term care. Any person who suspects financial.

Elder Financial Abuse Laws - State Overview.

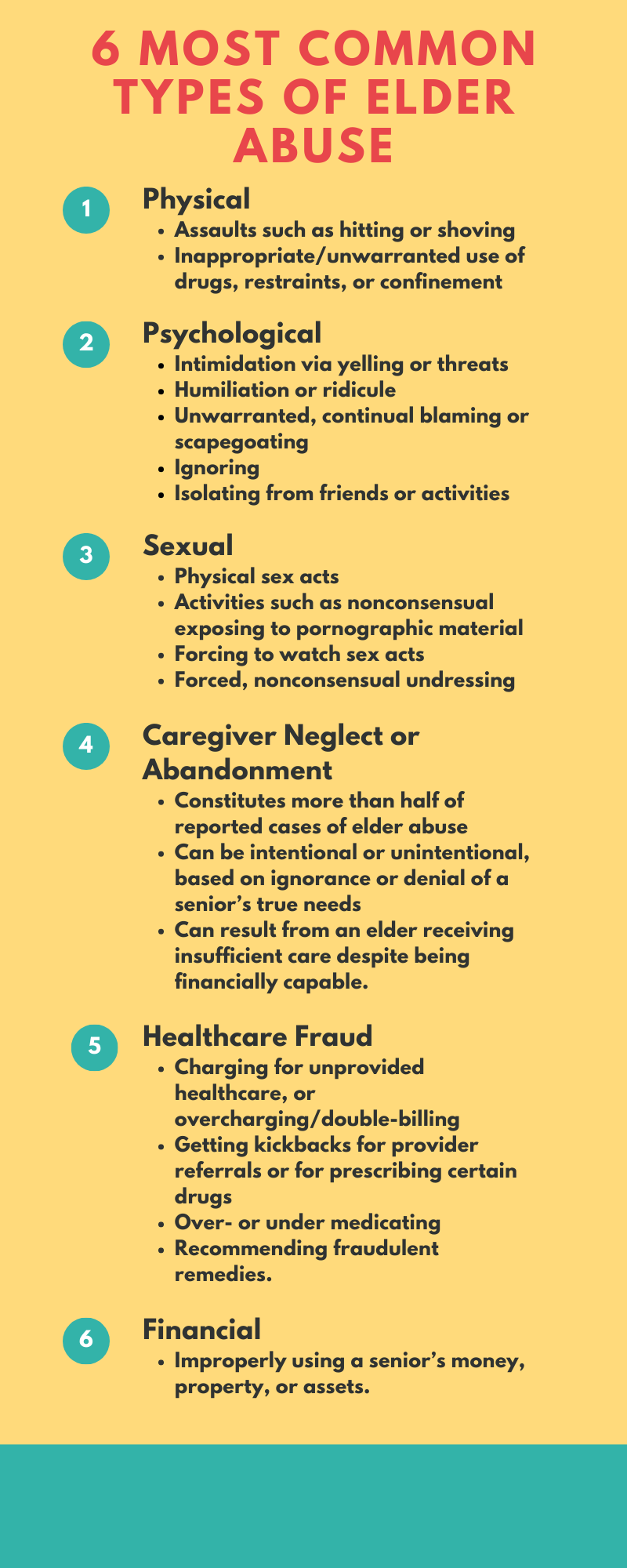

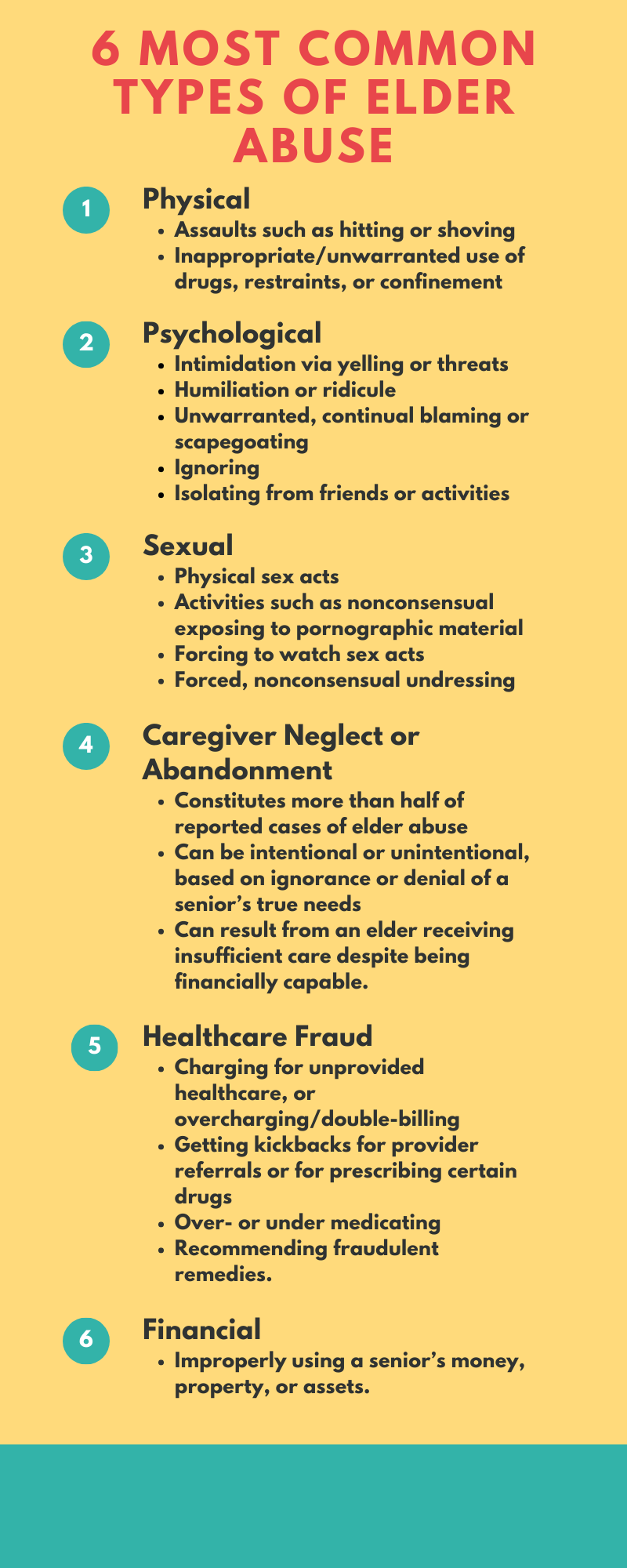

Pin By Bwd On Bwd Infographics Elder Abuse Awareness Elder Abuse Old Person

Help Keep Our Senior Citizens Safe From Financial Crimes Senior Citizen Abuse Prevention Elder Abuse

The Autonomy Group Legacy Planning Pc Elder Abuse Awareness Elder Abuse Holiday Specials

Elder Protection Programs Doea

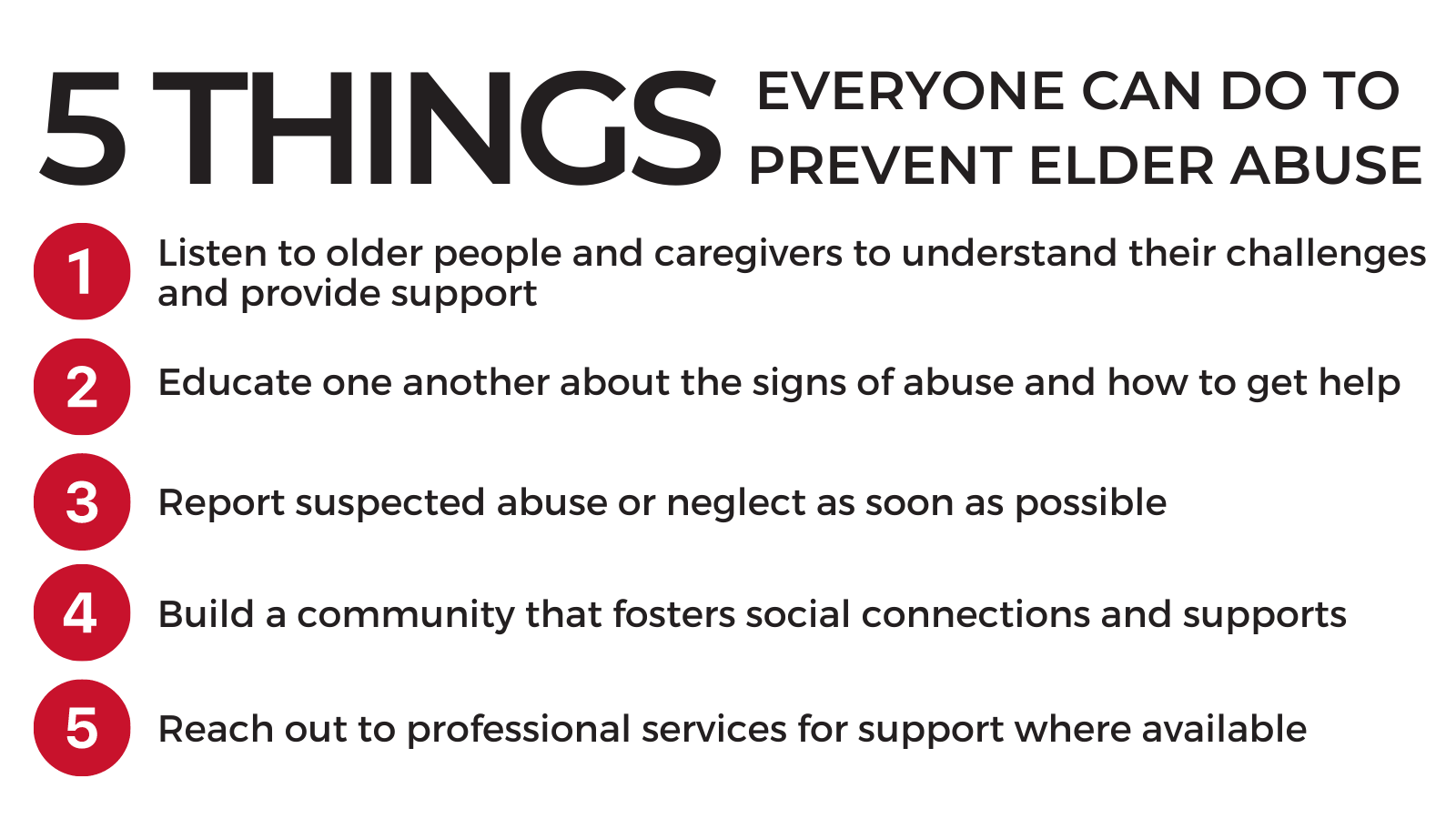

Preventing Elder Abuse And Neglect

When Should You Hire An Elder Abuse Attorney Top National Trial Lawyers For The Underdog

Posting Komentar untuk "Financial Elder Abuse Reporting Act"